Bitcoin New ATH $99,000

Bitcoin has experienced a significant surge recently NEW ATH, reaching a record high of nearly $99,000 on November 22, 2024

This rally has been driven by several key factors:

Institutional Investments: Bitcoin ETFs have seen massive inflows, with over $2.6 billion invested during recent weeks, BlackRock's iShares Bitcoin Trust and other ETFs have significantly boosted confidence in the market.

Broader Market Momentum: The global cryptocurrency market cap has grown to $3.26 trillion, with increased trading volumes reflecting strong interest from both retail and institutional investors. Ethereum, Solana, and other major cryptocurrencies have also recorded notable gains

Economic and Regulatory Developments: News such as the upcoming resignation of the SEC Chair and increasing adoption of Bitcoin as a financial instrument have added to the bullish sentiment. Additionally, strategic moves by major holders like MicroStrategy, which recently acquired over 51,000 BTC, have spurred market enthusiasm

This upward trend is part of a broader "Bitcoin Industrial Complex," where traditional financial institutions and crypto ecosystems increasingly intersect, fueling record trading volumes across related assets

Why is Bitcoin price up?

The Bitcoin Industrial Complex includes every TradFi equity and investment vehicle that can be affected by Bitcoin’s price and vice versa. It includes publicly traded stocks of MicroStrategy, Coinbase, and various Bitcoin miners and ETFs. However, it is a tradable investment vehicle on its own.

Balchunas added that MicroStrategy’s MSTR stock led most trading activity, recording $32 billion in trading volumes. On Nov. 20, MSTR became the most traded stock in the US, beating the likes of TSLA and NVDA for the first time in years.

The positive sentiment around MSTR also stems from the organization’s recent purchase of 51,780 BTC, or $4.6 billion, on Nov. 18, which increased MisroStrategy’s total holdings to 331,200 BTC.

Charles Edwards, Founder of Capriole Fund, also suggested Michael Saylor could buy another $3 billion in Bitcoin before Nov. 22.

Meanwhile, Bitcoin ETFs also recorded a net positive flow of $773 million on Nov. 20, increasing the total spot ETF inflows to $1.85 billion for the week

US investors continue to drive Bitcoin’s rally

Last week, the Bitcoin Coinbase premium index dropped by 80% after it reached a new H2 2024 high

While there were concerns of further sell-off coming into this week, the premium index has jumped back to its elevated levels, suggesting continued demand from US investors.

For that, we need the right strategy, and look at the state or world order because this is one of the factors that determines the rise or fall of Bitcoin prices.

CMIIW ^^

Telegram

Happy Cuan Airdrop is the Quickest way to discover legitimate cryptocurrency airdrops in your area!

Join our Telegram community.

Join now

If you found this article helpful.

You will love these ones as well.

23 Nov 2024

Common Terminologies in Airdrops and Cryptocurrency You Should Understand

13 Jan 2025

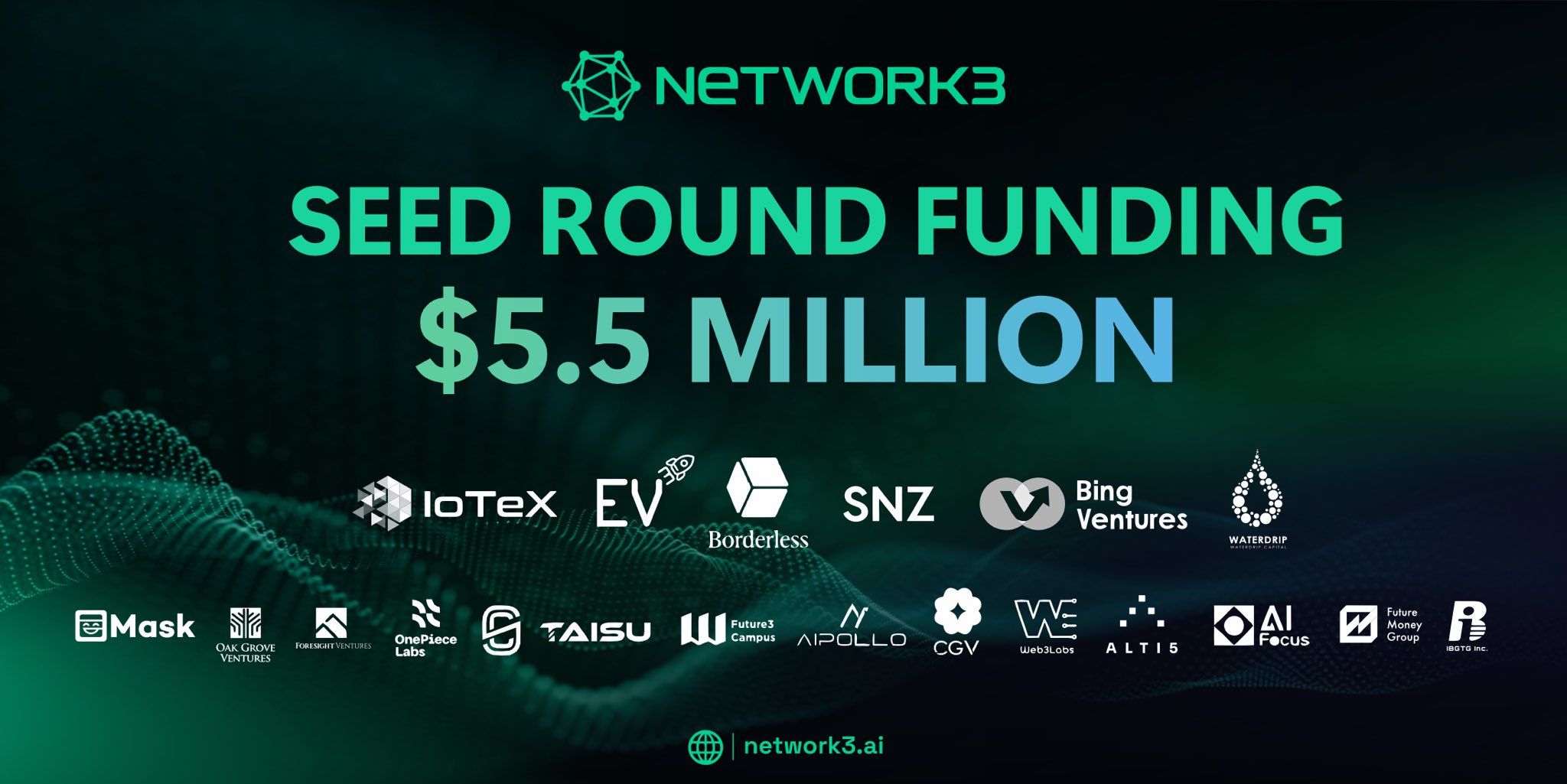

Network3 Node Ubuntu Installation Guide

18 Nov 2024

What This Is Retroactive Airdrop